News

Disability Insurance and Why You Need It

“Your most valued asset isn’t your house, car, or retirement account.

It’s the ability to make a living.”

No one foresees needing disability benefits. But, should a problem arise, the educated and informed employee can plan for the future by purchasing disability insurance to help cover expenses when needed.

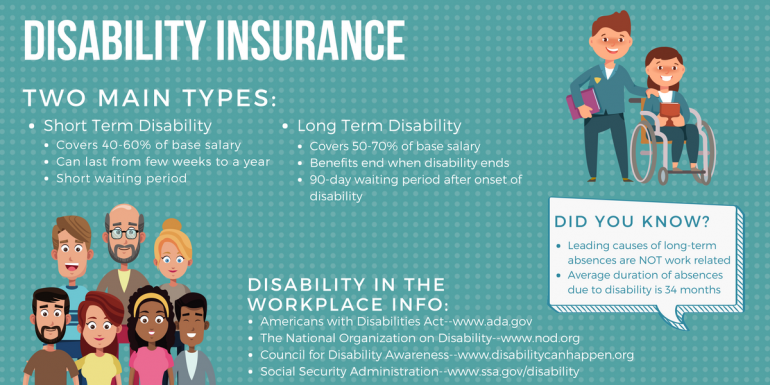

When you ask people what is the number one reason disability insurance is needed, most will answer that it is for workplace related injuries. However, the leading causes of long-term absences are back injuries, cancer, and heart disease and most of them are NOT work related. In addition, the average duration of absences due to disability is 34 months. So how do you prepare for an unplanned absence from work as a result of an injury or illness? Disability insurance is a great option.

Disability insurance is categorized into two main types.

- Short Term Disability covers 40-60% of the employee’s base salary and can last for a few weeks to a few months to a year. There is typically a short waiting period before benefits begin after the report of disability.This plan is generally sponsored by the employer.

- Long Term Disability covers 50-70% of the employee’s base salary and the benefits end when the disability ends or after a pre-set length of time depending on the policy. The wait period for benefits is longer—typically 90 days from onset of disability.This plan kicks in after the short-term coverage is exhausted. The individual purchases this plan to prevent a loss of coverage after short-term disability benefits are exhausted.

- Americans with Disabilities Act

- The National Organization on Disability

- Council for Disability Awareness

- Social Security Administration

While the benefits of these disability plans are not a total replacement of salary, they are designed for the employee to maintain their current standard of living while recovering from the injury or illness. This also allows the individual to pay regular expenses during this time.

There are many ways to enroll in a disability insurance plan. Often times your employer will offer long-term and short-term coverage as part of a benefits package. Supplemental coverage can also be purchased.Talk with your company’s HR department for more information on how to enroll in these plans.Individuals who are interested in purchasing supplemental coverage can also contact outside insurance brokers or even check with any professional organizations to which they belong (such as the American Medical Association for medical professionals) as many times they offer insurance coverage to members.

Additionally, some disability insurance plans limit the amount of benefits paid to the highly compensated insured individual. Plans typically cover 60% of the salary of the employee. Many plans only cover the base salary of its subscriber and not bonuses or commissions. So, in this example, if the employee earns a $250,000 base salary and an additional $150,000 in bonuses, should he become disabled, his monthly take home pay would not be $20,000 per month ($400,000 x 60% divided by 12 months) but instead would only be $12,500 per month ($250,000 x 60% divided by 12 months).Fortunately, there are supplemental insurance products that can assist in making up the difference in benefits. High-end disability programs allow for a greater monthly benefit for the individual who is highly compensated.Talk to your benefits professional about more information on this supplemental coverage.

As you begin planning for your future, make sure you research the types of coverage available and different avenues through which to purchase this coverage. For more information on disability and the workplace, check out: